Prohibition of interest or Riba

One of the distinguishing characteristics of Islamic economic system is the prohibition

of interest.

The Holy Book Quran uses the word

Riba for interest and defined as excessive interest or usury.

Islam has categorically prohibited the

giving or receiving of interest in any form.

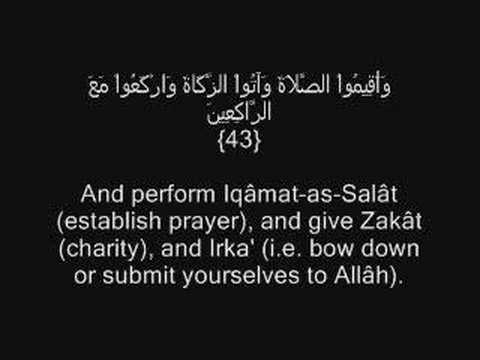

Allah said that “O you who believe! Fear God and give up what remains of your demand for usury, if you are indeed believers” [Al-Baqarah 2:278].

One of the Hadith the Prophet condemns the person who gives, receives, bears, witness or records any transaction that involves Riba.

As Ibrahim (2000) quoted from the Islamic Law

Academy‟s declaration, that forms of Riba can be in:

i) “any increase or profit on a loan which has matured in return for an extension of the maturity date, in the case where the borrower is unable to pay,

ii) and any increase or profit on the loan at the inception [beginning] of the loan agreement”

Ibrahim (2000) also briefly discusses some of the reasons why interest or Riba is against the Islamic spirit of justice and equity.

Here they are:

👎It discourages innovation by small businesses.

👎It leads to bankruptcy and results in loss of productive potential for the society as a

whole and causes unemployment.

👎The debt burden makes it difficult for a depressed economy to recover, bringing

additional suffering to the whole society.

👎Banks working in this system has no incentive to participate a venture. That is, they have no interest in the venture except in so far as there are possibilities of recovering their capital and earning interest, any investment plan put to them is evaluated on the basis of this criterion.

of interest.

The Holy Book Quran uses the word

Riba for interest and defined as excessive interest or usury.

Islam has categorically prohibited the

giving or receiving of interest in any form.

Allah said that “O you who believe! Fear God and give up what remains of your demand for usury, if you are indeed believers” [Al-Baqarah 2:278].

One of the Hadith the Prophet condemns the person who gives, receives, bears, witness or records any transaction that involves Riba.

As Ibrahim (2000) quoted from the Islamic Law

Academy‟s declaration, that forms of Riba can be in:

i) “any increase or profit on a loan which has matured in return for an extension of the maturity date, in the case where the borrower is unable to pay,

ii) and any increase or profit on the loan at the inception [beginning] of the loan agreement”

Ibrahim (2000) also briefly discusses some of the reasons why interest or Riba is against the Islamic spirit of justice and equity.

Here they are:

👎It discourages innovation by small businesses.

👎It leads to bankruptcy and results in loss of productive potential for the society as a

whole and causes unemployment.

👎The debt burden makes it difficult for a depressed economy to recover, bringing

additional suffering to the whole society.

👎Banks working in this system has no incentive to participate a venture. That is, they have no interest in the venture except in so far as there are possibilities of recovering their capital and earning interest, any investment plan put to them is evaluated on the basis of this criterion.

Reference : Assist. Prof. Dr. M. Kutluğhan Savaş ÖKTE, FUNDAMENTALS OF ISLAMIC ECONOMY AND FINANCE: THEORY AND PRACTICE (2010), Electronic Journal of Social Sciences, Winter-200 V.9 Is.31