ZAKAT

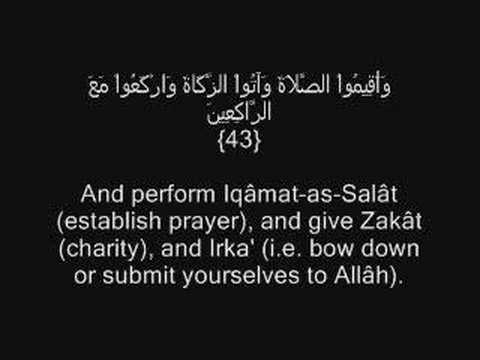

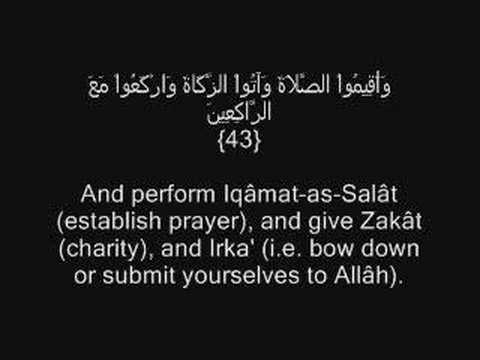

Zakat is a religious tax and an act of worship to please the God Almighty.

According to Rakiya Ibrahim (2000), :

The idea behind zakat “is to purify wealth and enhance its redistribution within the society and to prevent its hoarding.”

Certain categories of people are eligible to receive zakat:

👍the poor,

👍the needy,

👍debtors,

👍new converts,

👍slaves,

👍wayfarers,

👍zakat officials

👍and those that fight in the cause of God).

The types of assets that are subject to zakat are not specified.

Mohammed B. Sadr have a point of view according to this matter that “instances of zakat and Nisb [exemption limit] and their amount in each period are determined by ijitihad with regard to the condition of time and place” (Taheri, 2000, quoted from Sadr, 1994: p.237)Reference: Assist. Prof. Dr. M. Kutluğhan Savaş ÖKTE, FUNDAMENTALS OF ISLAMIC ECONOMY AND FINANCE: THEORY AND PRACTICE (2010), Electronic Journal of Social Sciences, Winter-200 V.9 Is.31

No comments:

Post a Comment